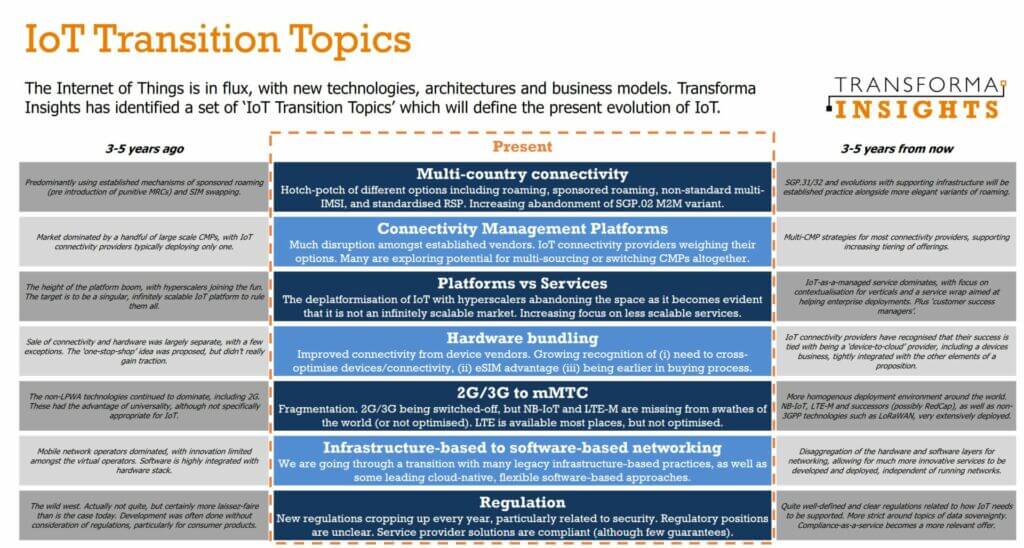

Transforma Insights’ analysts were recently at both the Mobile World Congress and Embedded World events which are key ones for the IoT space. Across both IoT events, the key theme can be summed up in one word: transition. In many different areas, IoT is evolving from a relatively stable, established environment three to five years ago towards another equally stable state in another three to five years. Today, however, we are going through a period of change. Some industry watchers have categorized this period of transition as a downturn in the fortunes of IoT, but we don’t agree. It is a natural realization of the appropriate way in which IoT should be delivered and a pivot toward that.

We will take a look at some of the key IoT Transition Topics that we noted. A forthcoming published report includes more transition themes and goes into further detail. More details of the Transition Topics are discussed in the report.

“Some industry watchers have categorized this period of transition as a downturn in the fortunes of IoT, but we don’t agree.”

-Transforma Insights

IoT Transition Topics

eSIM/Remote SIM Provisioning and Localization

If we look several years, the way to support cellular connectivity in multiple territories was relatively well defined: switch out SIM cards, use roaming, or rely on proprietary multi-IMSI solutions. If we look a few years into the future we would expect there to be a steady state of options including the use of SGP.31/32 IoT eSIM remote SIM provisioning (RSP), and probably some rather more refined and settled versions of permitted permanent roaming.

There was a significant disruption to the established order in 2020/2021 when some Mobile Network Operators (MNOs) started cracking down on the use of sponsored roaming on their networks. At around the same time, many MNOs became much more amenable to the idea of providing eSIM profiles, although, such arrangements remain patchy.

In addition to that has been the evolution of the technology landscape. For IoT devices, the SGP.02 M2M variant has been established but has rapidly become seen as yesterday’s technology as we await the SGP.31/32 IoT variant, although that won’t be available for use until well into 2024. So, we find ourselves in a period of flux.

Connectivity Management Platforms

The biggest piece of news in the IoT connectivity space for many years was announced in December: Aeris Communications would acquire the IoT capabilities of Ericsson, specifically IoT Accelerator (IoTA) and Connected Vehicle Cloud (CVC).

Ericsson is one of the “big two” in the Connectivity Management Platform (CMP) space, along with Cisco’s Control Center. Much of the gossip at Mobile World Congress particularly was the impact expected in the CMP space.

There is a trend for Communications Service Providers (CSPs) to be more proactive in reviewing their CMP strategy, looking to diversify into using alternative platforms. In some cases, they may want to find a replacement for existing main CMPs and in others, they are looking for low-cost variants as a secondary platform.

This approach is, in part, triggered by underlying requirements for CSPs to find low-touch onboarding suitable for addressing the prepaid IoT connectivity segment.

Whereas the prevailing approach three to five years ago was to have a single CMP from either Cisco or Ericsson, there is currently a lot of examination of that approach by many CSPs.

In the future, we expect to see a much more diverse landscape with multiple platforms used for different customer types. A forthcoming report on the CMP landscape will further explore this evolving market.

The Move From Platforms to Services

This is probably the most nebulous of our IoT Transition Topics, but also possibly the most far-reaching. One of the key discussion topics in IoT recently has been the apparent exits of many of the biggest technology vendors from the IoT space.

Companies such as Bosch, Google, and IBM have shuttered some of their IoT products and it seems like Microsoft is not far behind. The products that have been closed tend to have a very similar profile: generic IoT platforms that were intended to be infinitely scalable to address the entirety of IoT. That, however, is not how IoT works.

It has become apparent that IoT is not about infinitely scalable platforms. It is actually about providing the services and support to assist enterprises in deploying it. Enterprises, for the most part, need their hand-holding in some way in the deployment of their IoT projects. Ideally, this should be provided by a vendor with experience in delivering within the customer’s sector.

Our perspective is that these hyper scalers and other major technology vendors have not quit IoT. They’re all still heavily involved in IoT, providing edge computing, consulting, and, most prominently, the cloud functions in which IoT data is consumed, such as data lakes, digital twins, and real-time processing.

But they’re not typically very good at the contextualization part of IoT, and IoT is not very horizontal. It’s bought vertically, and horizontal platforms don’t necessarily address the needs of smart metering, fleet management, payment terminals, or whatever the specific use case might be.

Whereas years ago we were still at the peak of the IoT platform, today we are part way through the deplatformization of IoT and the recognition of this being at heart a market consisting of hundreds of discrete sub-markets each requiring their approach.

Does that mean IoT is therefore inherently less scalable than hoped? Yes. But specialization via a plethora of different vendors makes for an appropriately fragmented supplier ecosystem delivering better value.

Need for a Hardware Strategy & Cross-Optimization

Historically there was a relatively good distinction between hardware vendors and connectivity providers. That has evolved over the last couple of years with several major hardware vendors upgrading their connectivity offerings, most notably Quectel and Telit, to provide a more comprehensive offering combining connectivity and device.

Connectivity providers are also starting to get the message that perhaps there are benefits for them in being more involved with devices. The device is often the starting point for a development process while choosing a connectivity provider might be one of the last things on the list for an adopter. Being involved in devices introduces a connectivity provider earlier in the development process.

Another stimulus is the requirement for cross-optimization of devices, connectivity, protocols, application, cloud, and other IoT solution elements, something which has become even more pressing given the increasing use of more constrained (and IoT-appropriate) technologies.

Finally, the advent of eSIM/remote SIM provisioning, means that devices are increasingly shipping with a bootstrap IMSI already activated. This automatically provides the hardware vendor with an advantage in terms of addressing the customers’ connectivity needs. It’s not an overwhelming advantage, but it matters.

There are strong motivations for connectivity providers to have a better thought-out approach to devices. A forthcoming report on Device-to-Cloud strategies will address potential approaches to devices for non-device manufacturers.

2G/3G to Massive Machine-Type-Communications (mMTC)

The time horizon on this one is a bit longer than the standard three to five years considered in these Transition Topics. Mobile network operators (MNOs) around the world are going through a process of migrating from old legacy networks, specifically 2G and 3G, to newer more capable, and efficient technologies in the form of 4G and 5G.

In some countries, such as Australia, Japan, and the United States this process has been underway for a decade or more. In Europe, in contrast, it is a relatively recent development, with the first migrations happening in just the last two years, but with almost all operators now setting roadmaps for switching off in the next decade.

As a result, the networks used to carry the IoT traffic are changing dramatically. New NB-IoT and LTE-M networks are being introduced and in several cases are seeing quite a substantial adoption. This is another case of out with the old, in with the new, transitioning from 2G and 3G networks to NB-IoT and LTE-M networks.

And while we transition there are still some areas that need attention. Global coverage isn’t there yet, although growing, and roaming deals still need to be arranged. These are teething pains but the transition will ultimately result in the availability of much better technologies, more appropriate for IoT.

Infrastructure-Based to Software-Based

Another macro-theme in IoT connectivity today is the evolution from being focused on infrastructure to being focused on software. Network Function Virtualization, the simplicity of building middleware platforms and spinning up core networks, the availability of cloud storage, and similar trends, have virtualized the provision of connectivity.

Running an access network, as done by the Mobile Network Operators, is less and less critical to providing innovative connectivity services. As a result, the IoT MVNOs are increasingly assertive and doing interesting innovative things.

This doesn’t mean that the MNOs, such as AT&T, Deutsche Telekom, NTT, Verizon, and Vodafone should throw in the towel. Far from it. They remain the key players to beat.

However, they are certainly looking over their shoulders at the MVNOs and also thinking about how they could harness some of the ‘MVNO energy’ in their operations, in terms of being more cloud-native, faster moving, and reducing overheads.

Regulation

We see a changing regulatory environment emerging. Historically, the regulations affecting IoT were often not specifically related to IoT, and not necessarily rigorously applied, where they existed at all.

Today we are going through a period of the introduction of large amounts of regulation related to topics such as data sovereignty, knowing your customer, and particularly security. In the future, we see a greater level of clarity around the regulations that apply to IoT, which will in most cases be much stricter. Some of today’s approaches for multi-country support and associated architectures, as well as data management, used may not work in the future.

Compliance will become a much more significant topic. Whereas today it might be enough for individual suppliers to provide a compliant solution we also see a future opportunity for compliance-as-a-service, which ensures that IoT connections and all their associated systems, are compliant with regulations, and relevant partner policies.

Other Topics

These were not the only IoT transition topics being discussed. Others included the emerging requirement to manage the orchestration of data storage and processing between cloud and edge, the growing importance of private networks but with much still to be resolved about commercial models, and the topic of sustainability, perhaps the ultimate transition topic, related to the transition to zero carbon.

This is a very interesting time to be involved in the IoT transition as it is a constantly changing environment. One thing is for sure, it’s never dull!

Tweet

Share

Share

- Cellular

- Connectivity

- eSIM

- Hardware Components

- Internet of Things

- Cellular

- Connectivity

- eSIM

- Hardware Components

- Internet of Things